Major listed companies in the industry: Ping An Good Doctor (01833.HK); Ali Health (00241.HK); Meinian Health (002044), etc

Core data: chronic disease management revenue; Gross profit margin of chronic disease management enterprises; Chronic disease management business income

Chronic disease management industry listed companies summary

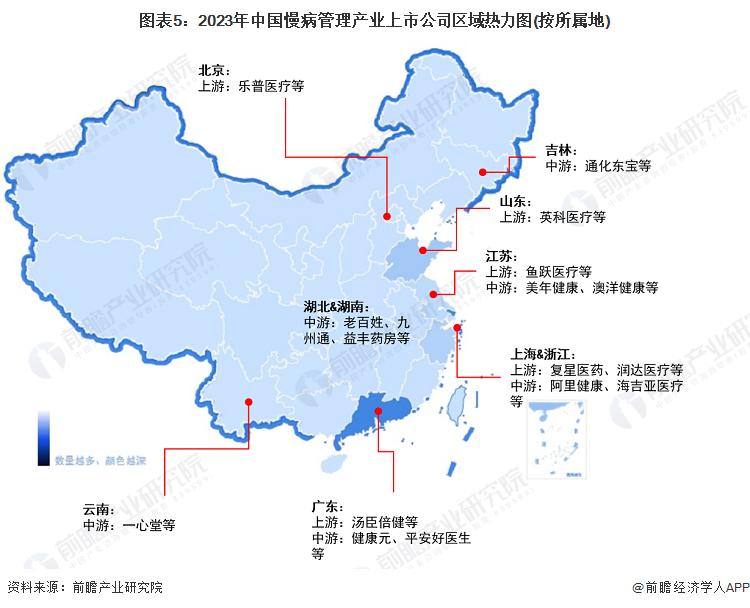

The upstream of chronic disease management is various chronic disease treatment medicines, medical devices and other service providers; The middle part of chronic disease management includes hospitals, health management centers, online medical service platforms and other chronic disease management service providers. Chronic disease management downstream for chronic patients.

Comparison of business layout of listed companies in chronic disease management industry

From the business layout of several chronic disease management enterprises, in 2022, Ali Health's chronic disease management business income was 11.501 billion yuan, ranking first in the industry, followed by Meinian Health and An good Doctor; From the business overview, the products of chronic disease management listed companies are mostly health management services, which are mainly in domestic markets such as East China and Central China, and less involved in overseas markets.

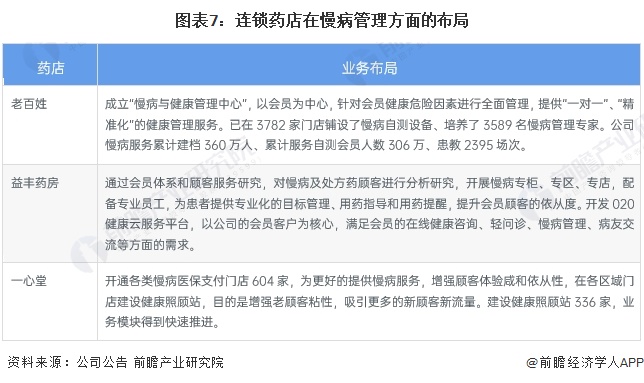

Among them, the domestic people, Feng pharmacy and other chain pharmacies actively carry out layout in chronic disease management:

Comparison of chronic disease management related business performance of listed companies in chronic disease management industry

In terms of chronic disease management enterprise performance, Ali Health's chronic disease management related business revenue reached 11.501 billion yuan, the largest scale; Followed by Meinian Health, the revenue in 2022 was 8.533 billion yuan, and the revenue of chronic disease management related businesses reached 8.116 billion yuan; Then came Ping An Good Doctor, with revenue of 6.16 billion yuan.

From the perspective of gross profit margin, the profitability of listed enterprises in the chronic disease management industry in 2022 is general, among which the gross profit rate of Yifeng Pharmacy and Tonghua Dongbao is better, reaching 48.56% and 43.08%, respectively, and the gross profit rate of other companies is generally concentrated in the range of 20%-40%.

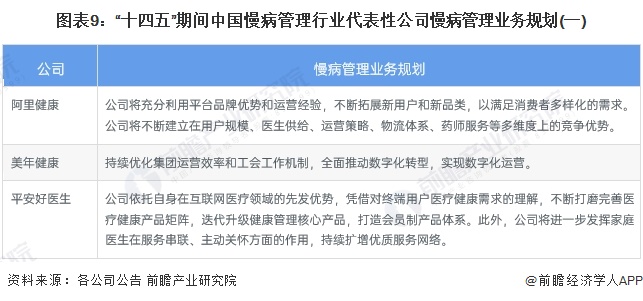

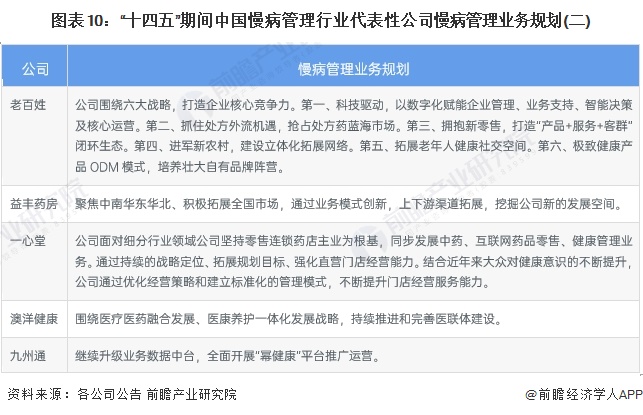

Comparison of chronic disease management business planning of listed companies in chronic disease management industry

During the "14th Five-Year Plan" period, the business planning of listed companies in the chronic disease management industry is to accelerate digital operation and construction, expand new customers and new products, and improve service quality, etc. The specific business planning is as follows:

For more research and analysis of this industry, please refer to the "China Chronic Disease Management Industry Market Foresight and Investment Strategic Planning Analysis Report" of Prospective Industry Research Institute.

|

Last:Reprint: Market segment analysis of China ophthalmic high-value consumables industry in 2024

Next:Appearance and function examination of surgical instruments |

Return |