Industry main listed companies: Aibo Medical; Guanhao; Hyalinidae; Diving medical treatment; Opcom; Ruizi Biology; Hypervision medicine

Core data: ophthalmic high value consumables industry chain; Development history of high value ophthalmic consumables; Competition pattern of high value ophthalmic consumables; Development status of high value ophthalmic consumables

Industry development overview

1. Definition

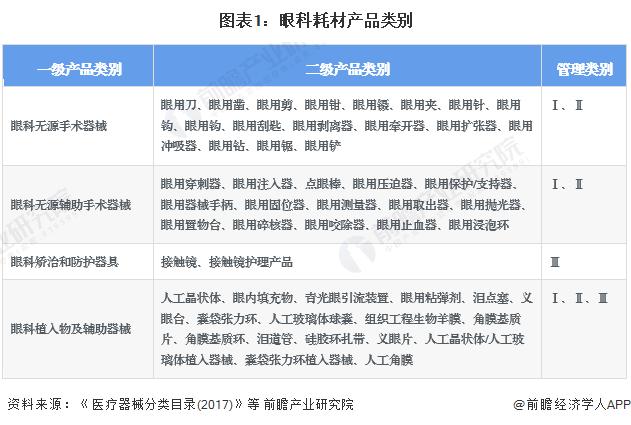

Ophthalmology, or ophthalmology, is the study of diseases that occur in the visual system, including the eyeball and its associated tissues. Common eye diseases include retinopathy, blindness, trachoma, cataracts, retinal detachment, myopia, glaucoma, etc. Ophthalmic consumables mainly refer to medical consumables used for the treatment of eye diseases. According to the data disclosed by the State Food and Drug Administration, ophthalmic consumables medical devices are mainly divided into ophthalmic passive surgical instruments, ophthalmic passive auxiliary surgical instruments, ophthalmic corrective and protective instruments, ophthalmic implants and auxiliary devices.

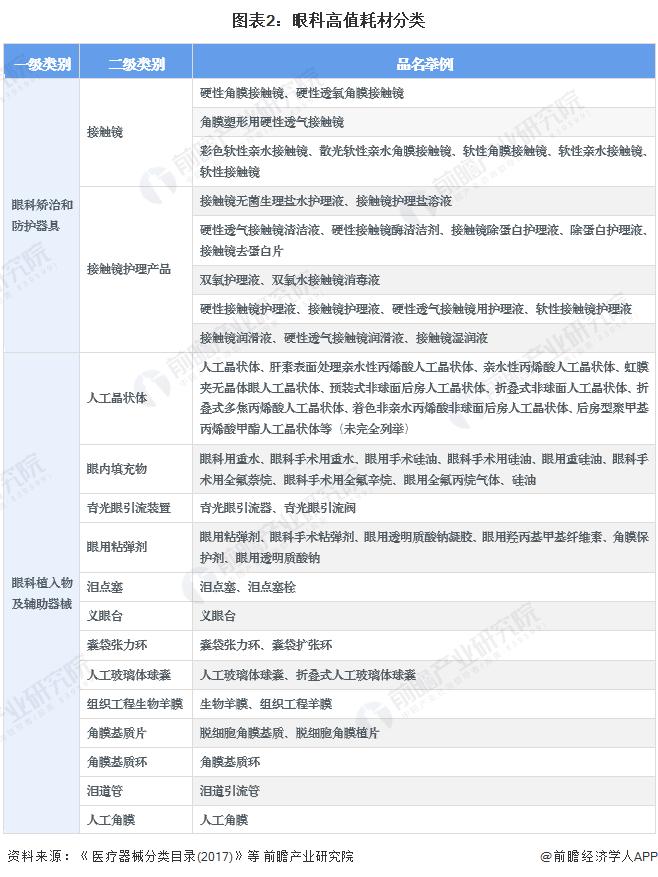

According to the value, ophthalmic consumables can be divided into high value ophthalmic consumables and low value ophthalmic consumables. Ophthalmic high-value consumables refer to high-value medical consumables used for the treatment of ophthalmic diseases, and ophthalmic high-value consumables are included in the third class of medical devices for management. According to the Classification Catalogue of Medical Devices (2017) and the Announcement of the State Food and Drug Administration on adjusting part of the Classification Catalogue of Medical Devices (No. 101 in 2023), the classification of ophthalmic high-value consumables is as follows:

2. Industrial chain analysis

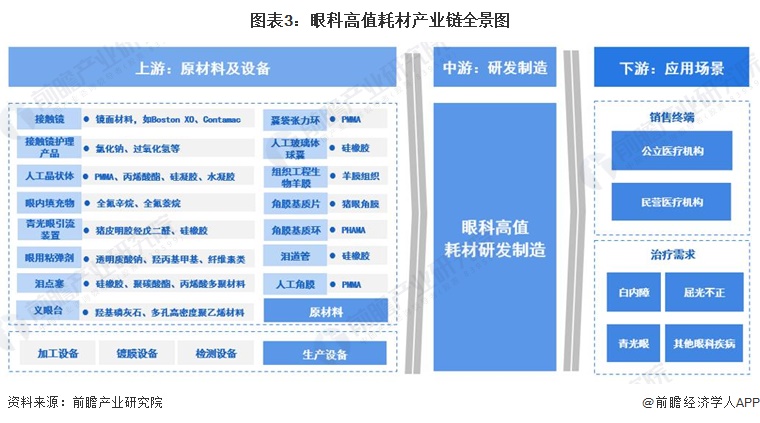

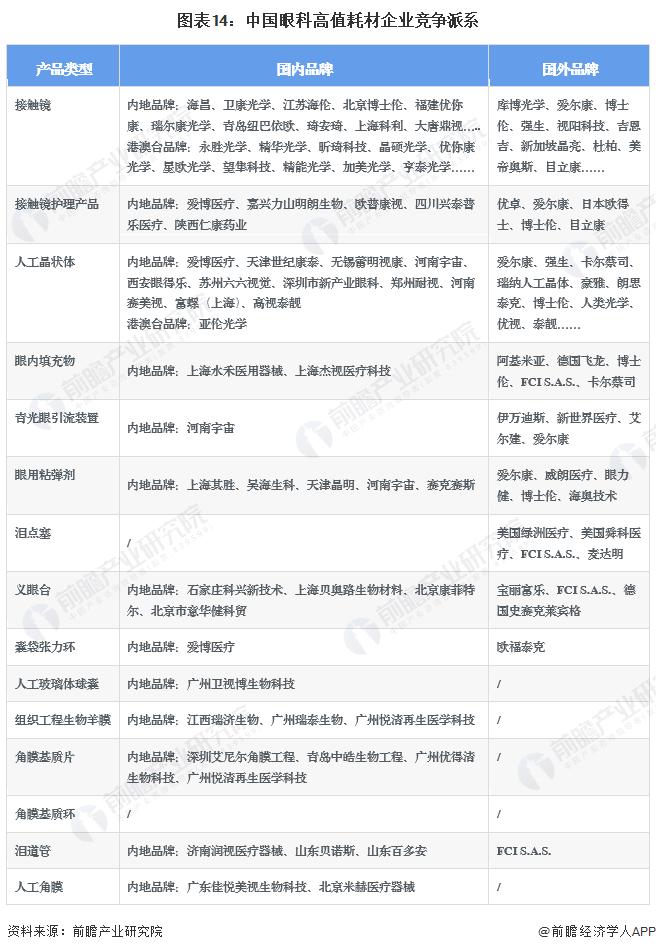

From the perspective of the industrial chain, the upstream of ophthalmic high-value consumables are mainly raw materials and production equipment, and the raw materials mainly include pharmaceutical polymer materials such as PHAMA materials and silicone rubber materials. There are certain differences in the raw materials types of different high-value consumables products. Production equipment mainly includes processing equipment, coating equipment, production equipment and so on. The middle reaches mainly include the research and development and manufacturing of high-value ophthalmic consumables such as contact lenses, contact lens care products, intraocular lenses, intraocular fillers, glaucoma drainage devices, ocular viscoelastic agents, lacrimal spot plugs, prosthetic eye table, pouch tension ring, artificial vitreous balloon, tissue engineering biological amniotic membrane, corneal stroma tablets, corneal stroma rings, lacrimal duct, artificial cornea, etc. The downstream sales terminals are public and private medical institutions, and the market demand is mainly for patients with cataracts, refractive errors and other eye diseases.

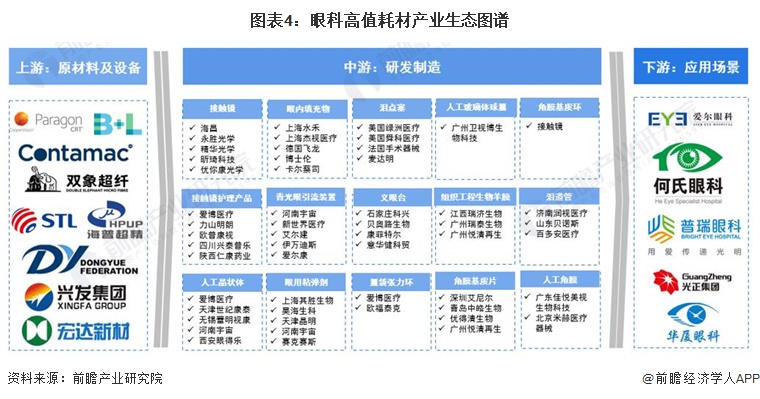

Ophthalmic high value consumables upstream lens material suppliers mainly include Bausch & Lomb, Paragon, Contamac, etc. Acrylate suppliers are mainly satellite Chemical, Baolijia, Kaitai Petrochemical, polymethyl methacrylate suppliers are mainly Shuangxiang shares; Polysiloxane suppliers are mainly Dongyue Silicon Materials, Xingfa Group; Silicone rubber suppliers are Hongda New material Chenhua shares, Tianchen new material; Polycarbonate suppliers are mainly Weiyuan shares, Cangzhou Dahua, Deqiao shares. Middle stream ophthalmic high-value consumables suppliers mainly include foreign enterprises such as Alcon, Johnson & Johnson, Carl Zeiss, Rena Intraocular lens, Bausch & Lomb, Tag Heuer, as well as local brands such as Aibo Medical, Haohai Sanke, Opcom, Ruiji Biological, Gaovision Medical, etc. Downstream eye medical institutions mainly include Aier Eye, He Eye, Purui Eye, Guangzheng Eye, Huasha Eye and so on.

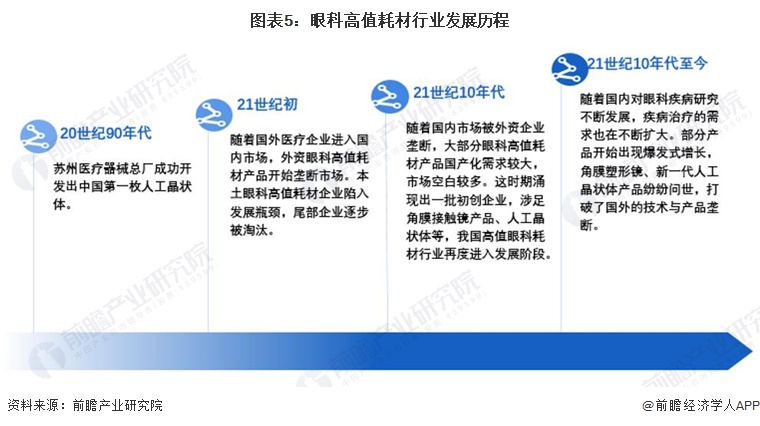

Industry development history

With the continuous development of domestic research on eye diseases, the demand for disease treatment is also expanding. Some products began to see explosive growth, orthokeratology mirrors, a new generation of intraocular lens products have come out, breaking the foreign technology and product monopoly. At present, most high value ophthalmic consumables in China are in a period of rapid development.

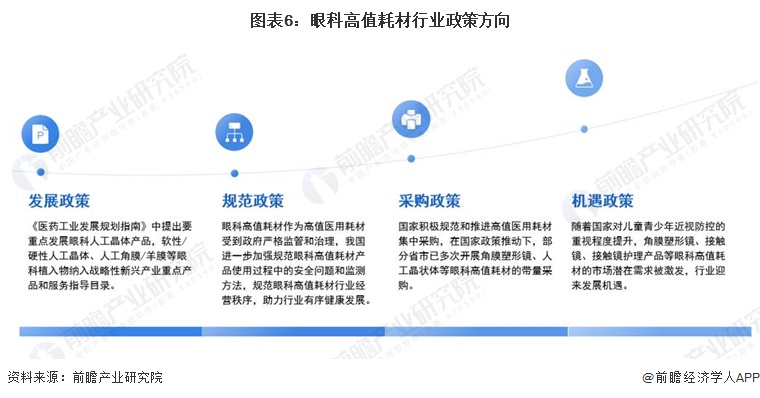

Industry policy background

The national policy of ophthalmic high value consumables industry can be divided into development policy, normative policy, procurement policy and opportunity policy. In terms of development policies, the "Pharmaceutical Industry Development Planning Guide" proposed to focus on the development of ophthalmic intraocular lens products, soft/hard intraocular lens, artificial cornea/amniotic membrane and other ophthalmic implants into the strategic emerging industry key products and services guidance directory; In terms of normative policies, ophthalmic high-value consumables as high-value medical consumables are strictly regulated and governed by the government, and China further strengthens the standardization of the safety issues and monitoring methods in the use of ophthalmic high-value consumables products, regulates the operation order of the ophthalmic high-value consumables industry, and helps the orderly and healthy development of the industry; In terms of procurement policy, the state actively regulates and promotes the centralized procurement of high-value medical consumables. Under the promotion of national policies, some provinces and cities have repeatedly carried out the procurement of high-value ophthalmic consumables such as orthopedic mirrors and intraocular lenses. In terms of opportunity policies, as the country attaches greater importance to the prevention and control of myopia in children and adolescents, the potential market demand for high-value ophthalmic consumables such as orthopedic lenses, contact lenses, and contact lens care products has been stimulated, and the industry has ushered in development opportunities.

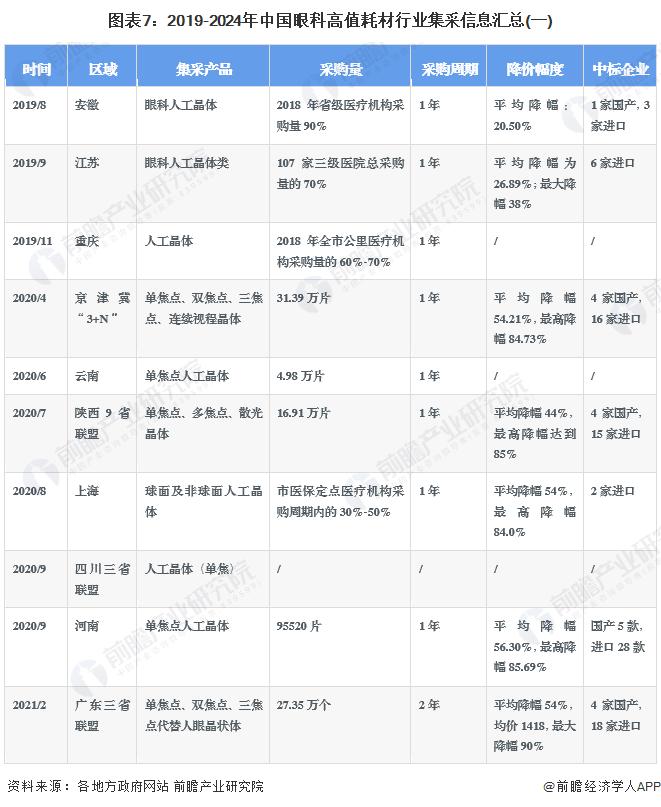

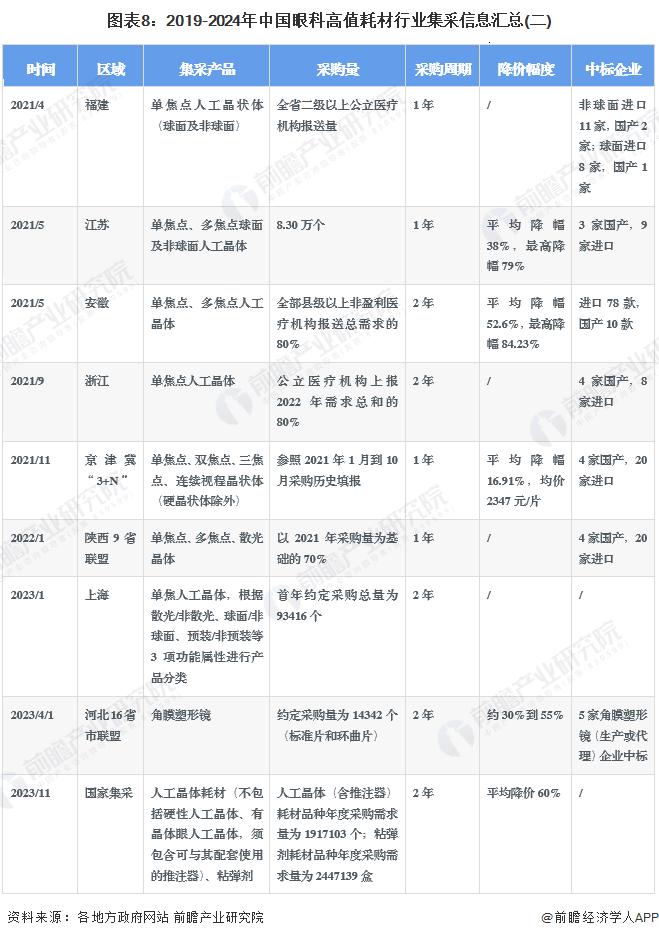

From the point of view of collection process, intraocular lens is the main variety of high value ophthalmic consumables centralized procurement in China. Since Anhui collection in August 2019, intraocular lenses have undergone about 17 rounds of local alliances and provincial collection, and the procurement varieties have also expanded from the early single-focus to multi-focus, continuous visual range and other categories. In April 2023, Hebei Province led the Sanming Procurement Alliance to issue centralized procurement documents, and a total of 16 provinces and cities participated in the collection, including Hebei Province, Hainan Province, Qinghai Province, Jiangxi Province, Guangxi Zhuang Autonomous Region, Sanming, Yuxi, Xiangxi, Jixi, Luoyang, Wuhai, Yuncheng, Hohhot, Zhoukou, Zhaotong, Xilin Gol. It is the first cross-provincial and large-scale collection of orthokeratology mirrors, which officially opened the prelude to the collection of orthokeratology mirrors. In November 2023, the state issued the "National Organization of intraocular lens and sports medicine medical consumables centralized Procurement Announcement (No. 2)", intraocular lens was officially included in the national collection range, according to the selection results show that the average price of intraocular lens consumables is 60%, the winning enterprise includes domestic enterprises such as Aibo Medical. Also includes Alcon, Johnson & Johnson, Bausch & Lomb, Zeiss and many other import enterprises. Under the promotion of the collection policy, the ophthalmic high-value consumables represented by intraocular lenses and orthokeratology mirrors will usher in the tide of price reduction and promote domestic substitution.

Industry development status

-- Registration: The peak period of registration was from 2015 to 2017

As of May 2024, the State Drug Administration issued a total of 892 ophthalmic high-value consumable product registration certificates within the validity period. From the trend of the first registration time, from 2015 to 2017, contact lens products set off a registration boom, driving ophthalmic high-value consumables products to enter the registration peak.

From the distribution of registered products, the number of contact lens product registration certificates is relatively large. As of May 2024, the State Medical Products Administration has issued 640 contact lens product registration certificates, accounting for about 72% of the total, which is much higher than other products. The second is the intraocular lens, the number of registration certificates is 169, accounting for 19%.

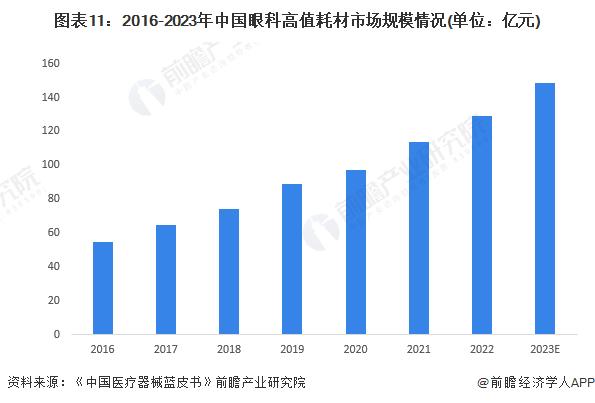

-- Market: The market size of ophthalmic high-value consumables is about 15 billion yuan

In recent years, under the influence of multiple factors such as the aging population, the increasing pressure of work and study, the excessive use of electronic products, and the improper use of eyes, the number of eye diagnosis and treatment in China has continued to rise. Under the condition of the continuous improvement of national health concept and the continuous growth of disposable income, the market of high-value ophthalmic medical consumables is growing rapidly. At the same time, the national policy is also paying more attention to eye health, and the future market sinking will add help to the development of the ophthalmic industry, and the market size will continue to expand. According to the medical device Blue Book data, in 2022, China's ophthalmic high-value consumables market size reached 12.9 billion yuan, 2016-2022 compound growth rate of 15%, 2023, the domestic ophthalmic high-value consumables market size of about 15 billion yuan.

Industry competition pattern

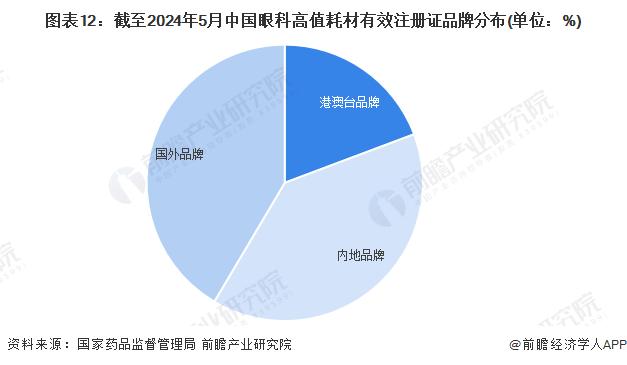

-- Overall market: The number of domestic enterprise registration certificates is slightly higher than that of foreign enterprises

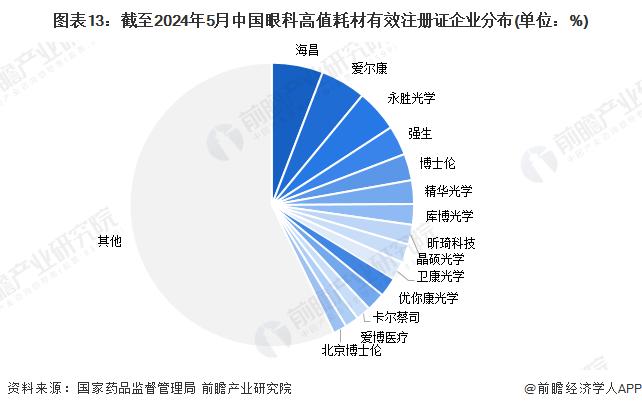

From the perspective of brand type, there are 892 valid registration certificates of domestic ophthalmic high-value consumables products, which are owned by 182 domestic and foreign enterprises. Among the 182 enterprises, 19 enterprises from Hong Kong, Macao and Taiwan, including Yongsheng Optics, Essence Optics, Xinqi Technology, Youyoukang Optics, Jingshuo Optics, etc.; 87 mainland enterprises, including Haichang, Weikang Optics, Jiangsu Helen Stealth, Aibo Medical, etc. 76 foreign companies, including Alcon, Johnson & Johnson, Bausch & Lomb, Cooper Optics, Carl Zeiss, Rayner intraocular lens and so on.

Specifically, the distribution of valid registration certificates for high value ophthalmic consumables is more dispersed, of which Haichang, Alcon, Yongsheng Optics, Johnson & Johnson, and Bausch & Lomb are among the top five, with 52, 46, 43, 30 and 20 valid registration certificates, respectively.

-- Market segments: The contact lens market is the most competitive

Ophthalmic high value consumables industry entry threshold is high, core medical equipment, high-end products have long been monopolized by imported products, domestic enterprises mainly to produce low-end products, but in recent years, they are also increasing the technology research and development of high-end products, the strength continues to increase.

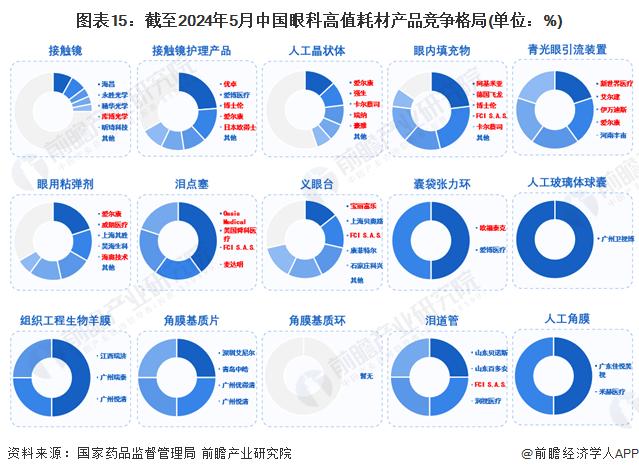

From the perspective of the competition pattern of various market segments, the market competition of contact lens and intraocular lens products is extremely fierce, and the market is relatively dispersed, and the market concentration of TOP5 enterprises is less than 50%. The market competition of contact lens care products, ophthalmic viscoelastic agents, ocular prosthesis and intraocular fillers is fierce. The rest of the product market segments are highly concentrated, and only a few enterprise products have passed registration and approval.

Note: 1) Draw according to the number of valid registration certificates of each enterprise in various products; 2) Red font indicates foreign enterprises

Industry development prospect and trend forecast

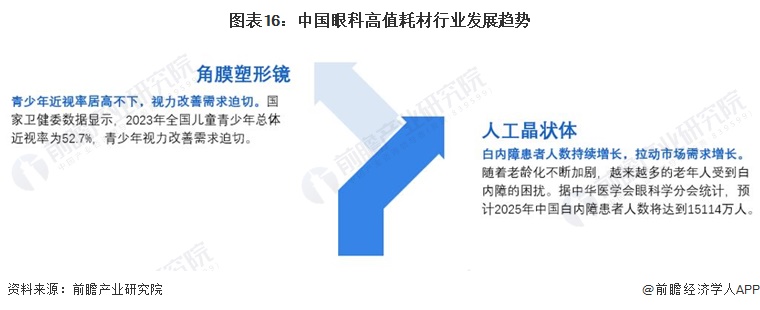

-- Development trend: Orthokeratology and intraocular lenses will explode in growth

Ophthalmic high value consumables are mainly used in retinopathy, blindness, trachoma, cataract, retinal detachment, myopia, glaucoma and other ophthalmic diseases. In recent years, the rate of myopia among adolescents in China remains high, and the number of cataract patients continues to increase. Myopia prevention and control and cataract treatment have become two key directions in the field of ophthalmology. Orthokeratology lens plays an important role in the prevention and control of myopia, and intraocular lens is the main medical product for the treatment of cataracts. In the future, orthokeratology lens and intraocular lens may explode.

-- Development prospect: The market size will exceed 30 billion yuan in 2029

With the continuous improvement of eye health awareness of Chinese residents, the gradual enhancement of the concept of medical treatment, the increase of medical consumption expenditure, the continuous improvement of CSR, and the acceleration of the aging process of the population, the market demand of China's ophthalmic high-value consumables industry will maintain rapid expansion, and the market size of China's ophthalmic high-value consumables industry will reach more than 30 billion yuan by 2029.

|

Last:Reprint: Analysis of driving factors of hyaluronic acid industry in China in 2024

Next:Reprint: High-end medical equipment has a new breakthrough! |

Return |