Since September 2023, a series of large acquisitions have taken place in the global medical technology sector, reflecting the trend of industry consolidation and market expansion.

These acquisitions not only help companies gain access to new technologies and markets, but may also drive overall innovation and progress in the medtech sector. Today, we will briefly review 27 large medical technology acquisitions in the past year for your reference.

# 01 Boston Scientific acquires Relievant Medsystems

On September 19, 2023, Boston Scientific announced that it had entered into a definitive agreement to acquire Relievant Medsystems, Inc.

The transaction includes an upfront cash payment of $850 million (about 6.2 billion yuan) and undisclosed milestone charges based on sales performance over the next three years.

Relievant Medsystems is a medical technology company focused on the diagnosis and treatment of spondylogenic low back pain, and its Intracept is the only FDA-approved device for the treatment of chronic spondylogenic low back pain.

# 02 Enovis acquires Lima

On September 25, 2023, Enovis Corporation, an innovative medical technology company, announced that it has entered into a definitive agreement to acquire bone and joint giant LimaCorporate.

The enterprise value of the acquisition is approximately 800 million euros (about 6.2 billion yuan), including the payment of 700 million euros in cash and 100 million euros in Enovis ordinary shares.

# 03 Jieding acquires Healthmark

In October 2023, Getinge announced that it had acquired 100% of U.S.-based Healthmark Industries, a leading supplier of innovative instrument care and infection control consumables, for approximately $320 million (RMB 2.3 billion).

Recently, Jieding announced the acquisition of Paragonix Technologies, a well-known American organ transport service company, and is expected to acquire Paragonix for $477 million (about 3.4 billion yuan). This includes a cash payment of $253 million and a potential milestone payment of $224 million by 2026.

# 04 Haemonetics acquires OpSens

On October 10, 2023, Haemonetics Corporation (NYSE: HAE), a global blood technology giant, announced that it has entered into a definitive acquisition agreement with OpSens, a company focused on cardiac medical devices.

Under the agreement, Haemonetics will acquire all of the outstanding shares of OpSens in a transaction with a fully diluted equity value of approximately $253 million at current exchange rates.

# 05 Inari Medical acquires LimFlow Medical

On November 2, 2023, Inari Medical announced that it had entered into a definitive agreement to acquire LimFlow Medical for up to $415 million.

Inari Medical said it expects to complete the acquisition by the end of 2023. Inari Medical will pay $250 million in cash upon closing and up to $165 million based on certain commercial and reimbursement milestones.

The deal comes just weeks after LimFlow received FDA premarket approval (PMA) for its breakthrough system for the treatment of chronic limb threatening ischemia (CLTI).

# 06 Johnson & Johnson acquires Laminar

On November 30, 2023, Johnson & Johnson Medical Technology (Johnson & Johnson's medical device business segment) announced the completion of the acquisition of Laminar, a company focused on developing innovative technologies for left atrial appendage (LAA) closure in nonvalvular atrial fibrillation, for an upfront payment of $400 million (approximately 2.84 billion yuan).

The Laminar LAA, developed by Laminar, is quite different from the Poco Watchman series and Abbott's Amplatzer Amulet in that it eliminates the left atrial ear through a "rotating motion" rather than blocking it. Laminar LAA is expected to avoid the drawbacks of traditional left ear occluders (such as thrombosis, leakage, lifelong anticoagulant use, etc.).

# 07 Smith & Nephew acquires CartiHeal

On November 22, 2023, orthopedic giant Smith & Nephew announced that the acquisition of orthopedic implant company CartiHeal has entered the stage of formal agreement.

Under the terms of the agreement, Smith & Smith will pay an initial cash consideration of $180 million upon closing, with additional cash payments of up to $150 million contingent on CartiHeal's post-acquisition financial performance.

Smith & Smith's acquisition is focused on CartiHeal's core product, the Agili-C™ implant, a porous, biotissue compatible, absorbable biphasic scaffold composed of interconnected natural inorganic calcium carbonate (aragonite) designed to promote the natural regeneration of articular cartilage by providing a supportive structure and promoting cell growth. And repair the structure of the subchondral bone.

Agili-C™ received the FDA Breakthrough Device designation in 2020 and PMA certification from the FDA in March 2022.

# 08 Integra Lifesciences acquires Johnson & Johnson Acclarent

On December 13, 2023, tissue repair giant Integra Lifesciences announced that the company has reached an agreement to acquire Acclarent, an ear, nose and throat (ENT) subsidiary of Johnson & Johnson, for $275 million (about 1.95 billion yuan) in cash.

n addition to the $275 million in cash, Integra Lifesciences said it will pay an additional $5 million when certain regulatory milestones are achieved. Following the acquisition, Acclarent will be integrated into Integra's CSS business unit. The transaction is expected to close in the second quarter of 2024.

# 09 ZimVie sells the spine business

On December 18, 2023, ZimVie, a leader in the global dental and spine markets, announced that it has reached an agreement to sell its spine business to private equity firm H.I.G. Capital, retaining only the company's dental business.

Upon completion of the transaction, ZimVie will receive a total consideration of US $375 million (approximately RMB 2.68 billion), consisting of US $315 million in cash (subject to adjustment for certain practices specified in the Agreement) and US $60 million in promissory notes (payable in kind at an annual interest rate of 10% compounded semiannually).

Integer acquires Pulse Technologies

In January 2024, medical equipment outsourcing maker Integer Holdings Corp. Announced the acquisition of Pulse Technologies, a manufacturer of medical device devices and components, for approximately $140 million.

# 11 Boston Scientific acquires Axonics

On January 8, 2024, Boston Scientific announced that it had agreed to acquire Axonics, a manufacturer of devices for the treatment of urinary and intestinal disorders, for a total of $3.7 billion (approximately 26.2 billion yuan) in cash.

Axonics' products are highly complementary to Boston Scientific's urology business, which accounts for approximately 14 percent of its fiscal 2023 pro forma sales.

With the completion of the acquisition, Poco will be able to take advantage of Axonics to enter the high-growth sacral neuroregulatory market and once again meet Medtronic.

However, the patent battle between Axonics and Medtronic has a long history, and between 2019 and 2021, the two have been in court, patent Trial and Appeal Board (PTAB) on patent issues for review, litigation, etc.

In April, Boston pushed back the expected closing of the deal to the second half of the year after receiving a second request from the FTC.

Axonics is one of Boston Scientific's larger acquisitions in recent years, but Jonathan Monson, senior vice president of investor relations, said he expects the deal size to increase in the future as the company grows in size, creating a strategic fit.

# 12 Haemonetics acquires Attune Medical

On April 2, 2024, Haemonetics, a global blood technology giant, announced that it has completed the acquisition of Attune Medical, a manufacturer of esophageal protection devices.

Attune Medical's main product, the active esophageal cooling device ensoETM, is currently the only FDA-approved thermoregulatory device to protect the esophagus during radiofrequency cardiac ablation.

At present, Weimei Blood has invested nearly 1 billion yuan in the field of cardiovascular intervention. Different from traditional acquisitions, the acquisitions of Only Blood are related to auxiliary devices in the field of cardiovascular intervention.

Generally, it will not compete fiercely with giant products such as Medtronic and Johnson & Johnson, but can complement their therapeutic devices. This is also a layout idea worth learning from.

# 13 Johnson & Johnson buys Shockwave

On April 5, 2024, Johnson & Johnson and Shockwave Medical announced that they have entered into a definitive agreement under which Johnson will acquire all outstanding shares of Shockwave for $335 per share.

The total value of the transaction is approximately $13.1 billion, including acquisition cash. The transaction has been approved by the boards of directors of both companies.

Shockwave is the first company in the world to offer intravascular lithotripsy (IVL) to provide innovative solutions for the treatment of calcified lesions in CAD and PAD.The acquisition of Shockwave will further strengthen Johnson & Johnson Medical Technologies' market leader position in cardiovascular interventions and accelerate its transition to higher growth markets.

# 14 Steris divested the dental department

In April 2024, Steris Medical announced that it had entered into a definitive agreement to spin off its dental division Hu-Fried to Peak Rock Capital for $787.5 million (RMB 5.699 billion).

The transaction is structured as an equity sale. The transaction is expected to close in the first quarter of the company's fiscal year 2025, allowing the spin-off to focus on customers in its core markets.

The terms of the transaction also include the opportunity for Starrett Healthcare to receive up to $12.5 million in additional proceeds, provided that HVRD achieves certain revenue targets in fiscal 2025.

# 15 Carl Zeiss acquires Dutch Ophthalmology

In April 2024, Carl Zeiss Medical announced that it had completed the acquisition of D.O.R.C. (Dutch Eye Research Center) for $1.07 billion (about 7.7 billion yuan).

The acquisition was originally announced on December 15, 2023. Under the agreement, Carl Zeiss will pay 985 million euros ($1.06 billion; At a total price of RMB 7.7 billion, it acquired 100% of the equity of DORC Ophthalmology in the Netherlands from Eurazeo, a French investment company.

# 16 Surmodics was acquired by GTCR

On May 29, 2024, Surmodics (NASDAQ: SRDX), a medical device surface coating and in vitro diagnostic technology provider, announced that it has agreed to be acquired by GTCR Corporation at a valuation of approximately $627 million.

The purchase price per share represents a 41.1% premium over Surmodics' 30-day volume-weighted average closing price as of May 28, 2024, and the transaction is expected to close in the second half of this year.

GTCR is an American private equity firm with a healthcare business.

Founded in 1979 and headquartered in the United States with operations in Ireland, Surmodics is a supplier of coating technology for vascular medical devices, in vitro diagnostic immunoassay testing and microarray chip chemical composition technology, and develops highly differentiated vascular interventional medical devices.

# 17 Boston Scientific acquires Silk Medical

In June 2024, Boston Scientific announced that it had entered into a definitive agreement to acquire Silk Road Medical.

Silk Road Medical is a medical device company that has developed innovative platform products to provide stroke prevention to carotid artery patients through a minimally invasive procedure called transcarotid revascularization (TCAR). The purchase price is $27.50 per share and the equity value is approximately $1.16 billion.

Subject to general closing conditions, Boston Scientific expects to close the transaction in the second half of 2024. Silk Road Medical's net revenue for 2024 is estimated to reach approximately $194 million to $198 million, an increase of 10% to 12% over the previous fiscal year.

Jp Morgan analyst Robbie Marcus said the deal "is a good deal for Boston because it's not expensive to acquire, but it makes enough sense to drive growth in the perimeter intervention business."

# 18 Bidi Medical acquires Edwards Critical Care Unit

In June 2024, Bidi Medical announced that it agreed to acquire Edward Life Sciences' critical care division for $4.2 billion (about 30.432 billion yuan) in cash, expanding Bidi Medical's medical monitoring product line and further consolidating its position in the global medical device market.

To finance the acquisition, Bidi Medical intends to use approximately $1 billion in cash and $3.2 billion in new debt.

The technologies included in the acquisition are: Swan Ganz pulmonary artery catheter, minimally invasive sensor, non-invasive blood pressure cuff, tissue oximeter sensor and monitor.

# 19 Meriton acquips EndoGastric Solution

On July 1, 2024, Merit Medical Systems (Nasdaq:MMSI), a leading global manufacturer of disposable instruments for cardiac and interventional radiological surgery, announced that it has entered into an asset purchase agreement with EndoGastric Solutions.

Under the agreement, Meritone paid a total cash consideration of US $105 million (RMB761 million) for the EsophyX Z+ device for the treatment of gastroesophageal reflux disease (GERD).

# 20 Alcon acquires BELKIN Vision

In July 2024, Swiss-American pharmaceutical and medical device giant Alcon officially announced that it had successfully completed its acquisition of BELKIN Vision for a total upfront consideration of up to $81 million, including a cash payment of approximately $65 million. There are additional payment terms of up to $385 million (RMB 2.8 billion) based on sales milestones.

Belkin Vision has developed a contactless automated laser treatment for glaucoma that is available to all ophthalmologists. Belkin Vision's Eagle™ glaucoma laser, currently available in the European Union and the United Kingdom, received a 510 (k) clearance from the FDA in December 2023, making it the first and only FDA-approved non-contact laser for glaucoma.

# 21 Edward acquires Innovalve

In July 2024, Edward Life Sciences (" Edward ") announced that it had exercised an option to acquire Innovalve Bio Medical, following its initial investment in 2017.Since 2017, Innovalve has made progress in its project and received significant early clinical evidence. The company's first TMVR system, Innostay, is currently in clinical trials.

The unique rotary operation of the Innostay valve allows both the valve prosthesis to be firmly attached to the natural tissue and the rotation of the "propeller" to narrow the mitral valve opening to fit the prosthesis, thus providing a strong anchoring and sealing effect, significantly improving the postoperative symptoms of mitral regurgitation (MR) patients.

Innovalve will be integrated into the transcatheter mitral and Tricuspid Valve Therapy (TMTT) business unit, led by Daveen Chopra, Edward's global vice president.

# 22 Owens & Minor acquires Rotech Healthcare

On July 23, 2024, Owens & Minor (NYSE:OMI), a leader in the U.S. medical market for disposable medical devices and surgical products, announced the signing of a definitive agreement. To acquire Rotech Healthcare, a provider of home medical devices, for nearly $1.4 billion (about 10.164 billion yuan) in cash.

Owens & Minor will acquire Rotech in an all-cash deal valued at $1.36 billion. The transaction is expected to result in tax benefits of approximately $40 million and a net purchase price of approximately $1.32 billion.

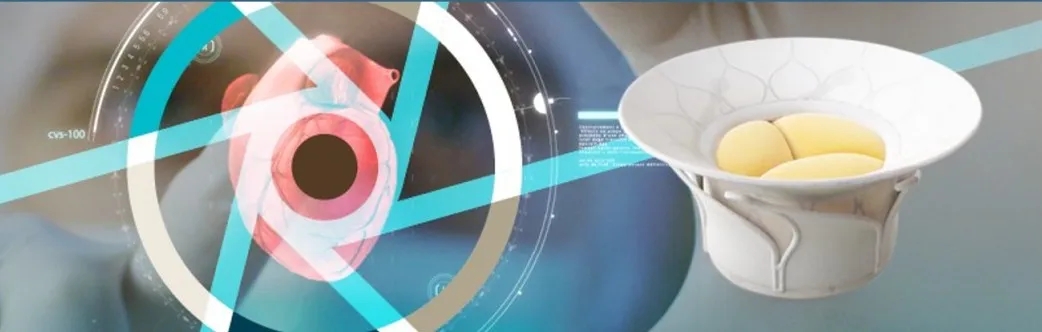

# 23 Edward acquires JenaValve and Endotronix

July 24, 2024, Edwards Lifesciences (NYSE: EW announced that it will continue to make two more acquisitions, spending $1.2 billion (about 8.712 billion yuan) to acquire JenaValve Technology and Endotronix.

Edward has reached an agreement to acquire JenaValve Technology, a pioneer in transcatheter aortic reflux (AR) therapy, and the JenaValve Trilogy™ heart valve system has the world's first Locators design for the treatment of aortic reflux.

It is the world's first and currently the only transfemoral TAVR system approved for the treatment of severe symptomatic aortic regurgitation or aortic stenosis.

Edward expects FDA approval of the JenaValve Trilogy heart valve system in late 2025, which would be the first approved treatment for AR p

# 24 Holotier acquires Endomag

On July 25, 2024, Hologic announced the completion of the acquisition of the UK company Endomag for US $310 million (2.247 billion yuan).

Following the acquisition, Hollotier expects to integrate Endomag's wireless intrabreast positioning technology and lymph tracking solutions into its surgical portfolio, providing breast surgeons and radiologists with more options.

Endomag develops and markets breast surgery localization and lymphatic tracking technologies. Its products include Magseed® markers for preoperative magnetic tissue localization, Magtrace® lymphatic tracer injections for breast cancer staging, and Sentimag® platforms for localization and lymphatic tracing. It is a complement to Hollojet's Tuloc/Tuflex, LOCalizer and TruNode products.

# 25 Baxter sells kidney care business

On August 13, 2024, Baxter Healthcare (NYSE: BAX), a global leader in medical technology, and Carlyle (NASDAQ: CG), a global investment firm, announced that they have signed a definitive agreement under which Carlyle will acquire Baxter's kidney care business, to be named Vantive, for $3.8 billion.

Under the terms of the definitive agreement, Baxter will receive approximately $3.5 billion in cash upon completion of certain settlement adjustments and is expected to receive a net after-tax gain of approximately $3 billion.

Vantive is a global leader in kidney care, offering products and services including continuous kidney replacement therapy (CRRT) for peritoneal dialysis, hemodialysis and vital organ support therapies. The business employs more than 23,000 people worldwide and has a 2023 turnover of $4.5 billion.

# 26 Johnson & Johnson buys V-Wave

On August 20, 2024, Johnson & Johnson announced that it had entered into a definitive agreement to acquire V-Wave, a manufacturer of atrial shunt devices.

Under the agreement, J&J will pay V-Wave an upfront payment of $600 million, in addition to the upfront payment, including potential additional regulatory and commercial milestone payments, totaling about $1.7 billion. The transaction is expected to close by the end of 2024.

Once the deal closes, Johnson & Johnson plans to integrate V-Wave into its medical technology division and make financial reporting part of its cardiovascular portfolio. Michael Bodner, group president of Cardiac Recovery and Endovascular lithotripsy, will take over V-Wave's team after the transaction closes.

# 27 Siemens Healthcare acquires Advanced Accelerator Applications

On August 24, 2024, Siemens Healthcare and Swiss pharmaceutical company Novartis reached an agreement to pay 200 million euros (about 1.6 billion yuan), The acquisition of the diagnostics business of Novartis' Advanced Accelerator Applications (AAA) is expected to close in the fourth quarter of this year.

Siemens Healthcare's acquisition is primarily aimed at growing its PET imaging business, with a total value of more than 200 million euros, or about $223 million, and will be used for the production of radioactive tracers for scanning neurological diseases including cancer, heart disease and Alzheimer's disease.

The transaction will enable Siemens Healthcare to further expand its US-focused PET diagnostics business in Europe, where AAA has the second largest network of cyclotrons for the production of radiomedical isotopes for the treatment of cancer, heart disease and neurological diseases.

|

Last:Reproduced:2024 health examination industry chain overview and regional heat map

Next:Reproduced:2024 The list of key products of high-end medical equipment was announced |

Return |