2024 is a key year for achieving the goals and tasks of the 14th Five-Year Plan. In the first half of the year, China's macro economy was generally stable, and new drivers of growth accelerated. The pharmaceutical industry has eliminated the impact of the novel coronavirus epidemic, showing positive signs of economic operation and making new achievements in high-quality development.

However, affected by a variety of factors, the main economic indicators of the pharmaceutical industry are still negative growth, the industry has entered the adjustment stage, enterprises are generally under pressure, and the development situation of the industry is more severe.

Key economic indicators have improved

According to the National Bureau of Statistics, in the first half of this year, the added value of the pharmaceutical industry above designated size increased by 1.2% year-on-year; The operating income of enterprises above designated size reached 1.466.55 billion yuan, down 1.4% year-on-year; Its profit was 211.12 billion yuan, down 1.2% year-on-year. The growth rate of the above three indicators is 4.8, 4.3 and 4.7 percentage points lower than the overall growth rate of the national industry, changing the trend of leading the industrial sector for many years. The positive change is that, by quarter, since the second half of 2023, the main economic indicators of the industry have improved, industrial added value has returned to positive growth, and the decline in revenue and profit has narrowed.

From the perspective of each sub-industry, the operating income of chemical apis and chemical preparations decreased slightly, but the profit increased. Traditional Chinese medicine decoction pieces is the only sub-industry that has achieved growth in revenue and profit. Biologics shrugged off the impact of COVID-19 vaccine products, and revenue returned to growth. Proprietary Chinese medicine, health materials and medical supplies, medical equipment and equipment, pharmaceutical special equipment 4 sub-industries operating revenue and profit declined. (See Table 1 for details)

Comprehensive analysis, the factors affecting the industry economic indicators in the first half of the year mainly have the following five aspects.

First, the export value of medicine has changed from negative to positive. In the first half of the year, enterprises above designated size achieved export delivery value of 175.63 billion yuan, an increase of 5.1%, 1.8 percentage points higher than the overall growth rate of the country. Among the sub-industries, the export delivery value of chemical raw materials decreased by 8.6% year-on-year, the rest of the sub-industries were positive growth, and 5 sub-industries also achieved double-digit growth, contributing to the increase of the industry economic indicators.

Second, the sales of innovative products have achieved a high growth rate, and the innovation-driven transformation has achieved obvious results. Some innovative drugs and biosimilar drugs approved in recent years, and early patented drugs with strong market exclusivity have maintained rapid sales growth, such as zeebutinib, bevacizumab, recombinant human thrombopoietin, and so on. For a group of Biotech companies that have not yet achieved profit, with the commercialization of new products and new indications after approval, and the realization of external authorization cooperation, the revenue increased significantly and the overall loss decreased significantly.

Third, domestic drug terminal sales showed negative growth. According to data from market consulting company IQVIA, the growth rate of hospital drug market in the first and second quarters of this year decreased by 1.4% and 0.2% respectively, although the sales of anti-tumor drugs maintained rapid growth, but the sales of proprietary Chinese medicines, anti-infective drugs and cardiovascular drugs with large amounts of drugs declined significantly. Mainly affected by lower sales of over-the-counter drugs, sales in the retail pharmacy market fell 1.2% in the first half of the year. In the field of vaccines, the number of vaccine batches issued in the first half of the year decreased by 2.8% year-on-year, and the number of batches issued for most varieties decreased. Falling drug prices, as well as the impact of some drug promotion in the context of strengthened industry regulation, are the main reasons for the decline in drug terminal sales.

Fourth, drug prices have fallen significantly. In March this year, the ninth batch of national drug collection and selection results began to be implemented. From national collection to local alliance collection, the scope of drug collection continues to expand, the variety increases, and the prices of new varieties and renewed varieties have declined to varying degrees. The "four same drugs" price management and drug price comparison policy have further reduced the prices of many varieties. According to hospital drug market data released by Pharmaceutical Cube, drug sales in sample hospitals achieved a year-on-year growth of about 10% in the first half of the year, but the overall sales were basically flat, showing the negative impact of price factors. In the first half of the year, the prices of raw materials rose and fell, and the prices of some products stabilized, showing changes in market supply and demand and phased balance.

Fifth, the industry faces the risk of contraction. Research shows that in the face of market uncertainty and competition, enterprises generally reduce costs and efficiency, reduce capital expenditure, control labor costs, and many research and development companies reduce research and development investment, which has also led to a serious decline in CXO, pharmaceutical equipment and other areas of revenue. In addition, many enterprises have high inventories, increased accounts receivable, and the financial pressure on some hospitals is transmitted to enterprises, affecting the overall operating efficiency and quality of the industry.

The new policy promotes the improvement of industrial quality and efficiency

A series of policies to improve the quality and efficiency of industries. This year's government work report proposed for the first time to accelerate the development of innovative drugs and other industries; The Executive meeting of The State Council reviewed and adopted the Implementation Plan for the Whole Chain to Support the Development of Innovative Drugs, strengthening the policy guarantee for the development of innovative drugs in many aspects; A number of provinces and cities represented by Beijing, Shanghai, Jiangsu, Shandong, etc., have introduced relevant whole-chain innovative drug support policies. Since the beginning of this year, the state and local governments have implemented a series of policies to stimulate economic growth, promoting large-scale equipment renewal and replacing old consumer goods with new ones, promoting equipment renewal in the medical and health sector, and issuing ultra-long-term Treasury bonds, which have strongly promoted investment, promoted the development of the pharmaceutical industry to improve quality and efficiency, and injected new momentum into high-quality development.

Steady progress was made in deepening medical reform

The "Key Tasks for Deepening the Reform of the Medical and Health System in 2024" focuses on the coordinated development of the "three doctors". The Notice on Strengthening Regional Cooperation to Improve the quality and Expansion of Centralized Pharmaceutical Procurement in 2024 promotes the quality and expansion of drug collection, encourages qualified regions to take the lead in carrying out national joint production, focusing on covering the "large varieties" of chemical drugs and clinical drugs that have not been uniformly evaluated; Encourage village clinics, private medical institutions and retail pharmacies to participate in the collection.

The National Medical Insurance Administration has carried out drug price control, and issued the Notice on Promoting Fair, Honest, Transparent and Balanced Inter-provincial Prices of Drugs with the same generic name and brand to promote more transparent and balanced inter-provincial drug prices. Solicit opinions on the initial price formation mechanism of newly listed drugs, encourage clinical value-oriented drug research and development innovation, and the higher the evaluation in terms of pharmacy, clinical value, and evidence-based evidence, the higher the freedom of drug pricing. The National Health Commission publicized the "Fifth batch of Recommendations to Encourage research and development of children's Drugs" to guide enterprises to carry out related product research and development.

The drug review and approval system has been continuously improved

The Center for Drug Evaluation (CDE) of the State Food and Drug Administration has issued more than 40 technical guidelines covering stem cell products, radiopharmaceuticals, antibody-coupled drugs (ADCs), pharmaceutical research, clinical trials, and manufacturing process quality control. The State Food and Drug Administration issued the Pilot Work Plan for Optimizing the Review and Approval Procedures for Supplementary Drug Applications, and conditional provincial drug administration departments provide pre-emptive services to shorten the technical review time for enterprises in the province to verify and inspect supplementary applications. In addition, the State Drug Administration was re-elected for the third time as a member of the Management Committee of ICH (International Technical Coordination Committee for Human Drugs), steadily promoted the work of joining PIC/S, and accelerated the technical standards and management level of China's new drug development and registration with international standards.

Domestic innovative drugs have achieved remarkable results

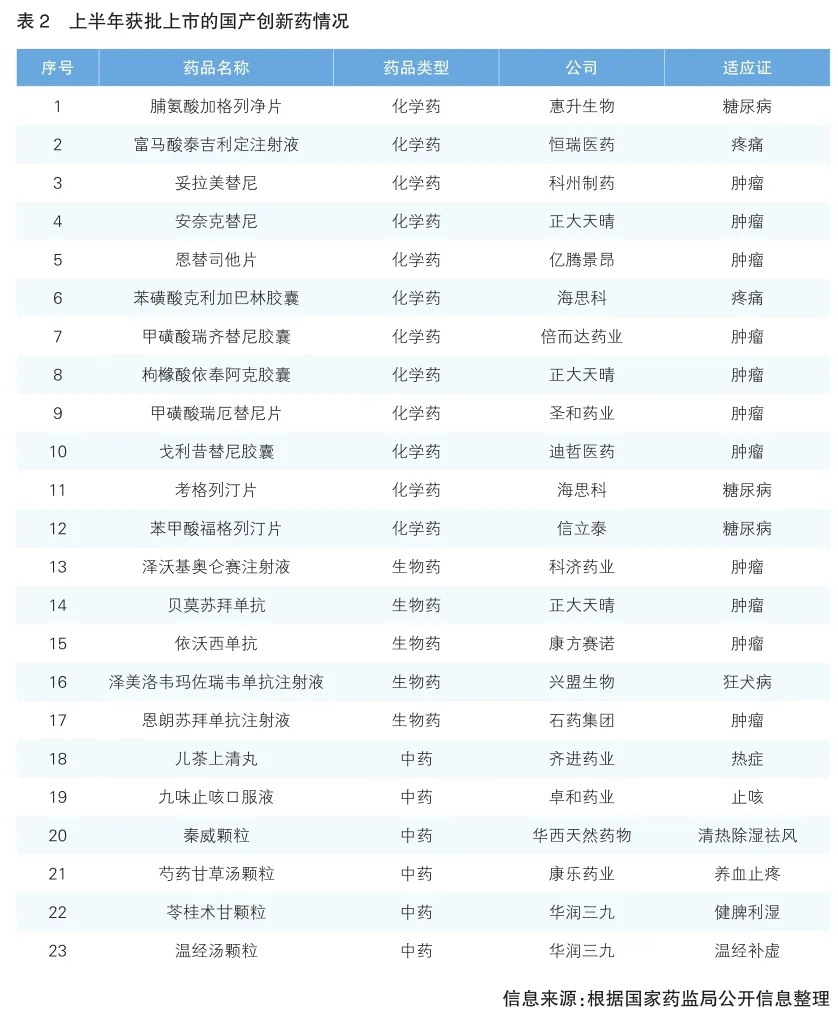

Pharmaceutical innovation continued to reap results, with a total of 23 domestic innovative drugs approved for market in the first half of the year, including 12 chemical drugs, 5 biological drugs and 6 traditional Chinese medicines. Among them, the field of chemical drug treatment is mainly tumor drugs.

From the perspective of the main body of enterprises, the proportion of innovative drugs approved by traditional large pharmaceutical enterprises is more, Zhengda Tianqing has 3 new drugs, Hesco has 2 new drugs, and China Resources 39 has 2 ancient classic famous traditional Chinese medicine compound preparations approved for listing.

The number of technologically innovative products has increased. For example, ebraxizumab is the world's first PD-1/VEGF double antibody, Golicitinib capsule is a highly selective JAK1 inhibitor in the field of lymphoma treatment, Tolatinib capsule is the first MEK inhibitor in China, and anerictinib fumarate capsule is the first domestic targeted drug for ROS1 positive non-small cell lung cancer (NSCLC). Zwerky Oroncel injection is the fifth CAR-T product in China. The listing of these products has created conditions for improving the level of clinical drug use. (See Table 2 for details)

According to incomplete statistics, in the first half of the year, domestic pharmaceutical companies reached at least 30 License-out authorization cooperation in the field of innovative drugs, with a total amount of more than 20 billion US dollars. Among them, the total transaction volume of a single project exceeded 1 billion US dollars: Hengrui Pharmaceutical authorized GLP-1 product portfolio to Hercules, Huamax Pharmaceutical authorized RNAi therapeutic products to Novartis, and Mingji Biological and Aseng Pharmaceutical authorized relevant products to AbbVie, Takeda and other multinational companies respectively.

In terms of drug types, the traded products cover small molecule drugs, ADCs, antibody drugs, nucleic acid drugs, peptide drugs, vaccines, etc. In terms of transaction types, in addition to product authorization, a number of technology platform transactions were also reached, such as Corning Jerry and Yilian Biologics authorized ADC technology platforms to ArriVent and BioNTech, and Ruibo Biologics and Bolinger Ingelheim jointly developed MASH related small nucleic acid drugs. In addition, there have been several foreign acquisitions based on innovative products, such as Nuvation's acquisition of Baoyuan Pharmaceuticals and Genmab's acquisition of Pufang Biologics.

All-round expansion of overseas markets

In a complex international market environment, pharmaceutical exports have achieved growth. In the first half of the year, pharmaceutical enterprises above designated size achieved a year-on-year increase of 5.1% in export delivery value. According to the data of the China Chamber of Commerce for Import and Export of Pharmaceutical Products, the export value of pharmaceutical products in the first half of the year was 52.579 billion US dollars, an increase of 1.91%, of which the export value of the top three markets along the "Belt and Road", the European Union and the United States increased by 3.59%, 3.8% and 5.21% respectively. The export price of chemical raw materials, which accounted for about 40% of the export value, showed a rebound trend, which played a key role in the stabilization of the overall export. Exports of chemical preparations, medical devices and other products grew rapidly, contributing to the increase in overall exports.

Local pharmaceutical companies are expanding overseas markets in an all-round way. In terms of chemical apis, in the first half of the year, 275 chemical apis of 153 companies were filed by the US Food and Drug Administration (FDA) DMF, accounting for about 40% of the total number of FDA filings in the first half of the year. In terms of generic drugs, in the first half of the year, a total of 15 companies obtained 40 ANDA approvals (37 varieties) from the US FDA, and the top three companies with the number of approvals were Fosun Pharmaceutical, Pu Pharmaceutical and Qilu Pharmaceutical, and the dosage forms were mainly concentrated on injections. In terms of innovative drugs, in the first half of the year, Sea and drug's Glumetinib was approved for listing in Japan, Cornerstone Biological's Suglizumab was approved for listing in the European Union, and a number of innovative drugs are in the late stage of international multi-center clinical trials or NDA stage, and it is expected that the number of domestic innovative drugs listed overseas will continue to grow. In addition, Qilu Pharmaceutical's lezumab and Biaotai's tolumab biosimilars have been approved for marketing in the European Union, and Fuhonghanlin's Trastuzumab biosimilars have been approved for listing in the United States, accelerating the pace of internationalization of biosimilars. More and more enterprises enter the Southeast Asian market, through the export of products, investment and construction of factories to explore the relevant national market, some CXO companies are facing the European and American market demand, and actively expand overseas production service base.

Corporate revenue growth is slowing and profits are falling

In the context of the overall negative growth of the industry, many leading enterprises in the industry have slowed down revenue growth and decreased profits. From the semi-annual report of A-share listed companies, the operating income growth rate of listed companies in the pharmaceutical industry as an industry advantage is only 0.1%, and nearly 50% of the profits of enterprises have declined. Innovative transformation enterprises and some emerging innovative drug companies have maintained good growth and profitability, and some enterprises represented by Hengrui Pharmaceutical and Beigene have reached a new high in innovative drug revenue. However, at the same time, business difficulties in the increase of enterprises, according to statistics, the first half of the scale of pharmaceutical industry enterprises above the loss of enterprises accounted for 32.3%, an increase of 8.5%, but the total loss narrowed by 4%.

The investment and financing environment has further cooled. Affected by changes in the capital market environment, industry competition and policy adjustments, the valuation of the A-share and Hong Kong pharmaceutical sectors has continued to decline and is at A historically low level. In the first half of the year, the pharmaceutical industry completed about 400 VC/PE investment and financing projects in the primary market, with a cumulative amount of about 30 billion yuan, which continued to decline year-on-year; In the secondary market, only four pharmaceutical industry companies are listed in A-shares or Hong Kong stocks. With the significant tightening of the IPO policy, the development of R&D small and medium-sized drug enterprises is facing huge operating pressure, and it is necessary to maintain operations by reducing salaries and laying off staff, selling or shelving research projects, which has an adverse impact on pharmaceutical innovation.

According to statistics, in the first half of the year, the operating income of the pharmaceutical industry in 11 provinces (autonomous regions and municipalities) achieved positive growth, of which 5 provinces (autonomous regions) including Xinjiang, Heilongjiang, Hainan, Anhui and Jiangsu saw double growth in operating income and profit, and the growth rate of operating income and profit in Xinjiang reached double digits. The revenue of Jiangsu, Guangdong, Shandong, Henan, Zhejiang and other major pharmaceutical provinces exceeded 100 billion yuan. At the same time, the operating income and profit of some provinces have fallen by double digits, and stable growth is facing greater pressure.

Policies and measures were introduced to further support the development of the whole chain of the pharmaceutical industry. Nine departments in Beijing jointly issued a number of measures to support the high-quality development of innovative medicine, and put forward 32 measures from 8 aspects of innovative medical device research and development, clinical trials, review and approval, manufacturing, circulation and trade, and clinical application. The "Several Opinions on Supporting the Innovation and Development of the Whole Chain of the Biomedical Industry" of Shanghai Municipality proposes to build a highland and innovation engine of the biomedical industry with international influence. The implementation plan of Jiangsu Province innovative pharmaceutical device incentive Policy arranges 166 million yuan incentive funds to support innovative enterprises and innovative products. Shandong Province's "Several Measures on Optimizing the Review and Approval Services to Promote the High-quality Development of the Pharmaceutical Industry" highlights innovation leadership and improves the efficiency of the whole process of service.

Looking forward to the whole year, the international development environment is complex, and the domestic development environment is expected to continue the trend of the first half of the year, in the face of external pressures such as the reform of medical insurance payment methods, drug price governance, the slowdown of medical insurance fund financing, and the contraction of pharmaceutical investment and financing, the pharmaceutical industry still has no small difficulty in achieving positive annual operating income growth. But at the same time, it should be seen that the pharmaceutical industry has strong resilience, and external pressure will promote the industry to accelerate the adjustment and reshuffle, promote the integration of products, production capacity, and enterprise resources, and accelerate the adjustment and upgrading of industrial structure. As a series of policies from the national to local governments to encourage the innovation and development of the pharmaceutical industry gradually take effect, and new driving forces such as innovation-driven transformation and pharmaceutical export upgrading are formed, it is expected that the pharmaceutical industry can quickly return to the track of stable growth.

|

Last:Reproduced:Discussion on current situation and development path of innovative medical device policy

Next:Reproduced:China rehabilitation medical equipment |

Return |