Core data: Classification of high value ophthalmic consumables; Distribution of ophthalmic high value consumables registered products; Competition pattern of ophthalmic high value consumables; Localization rate of ophthalmic high value consumables

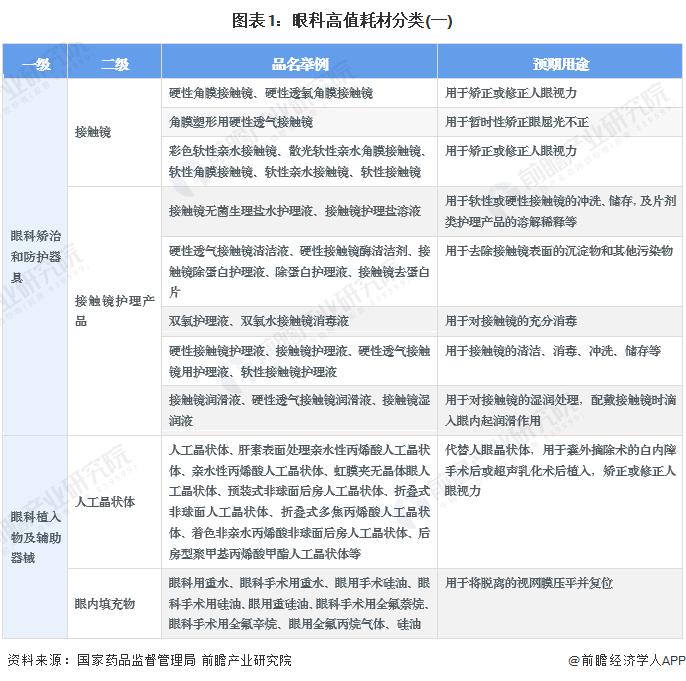

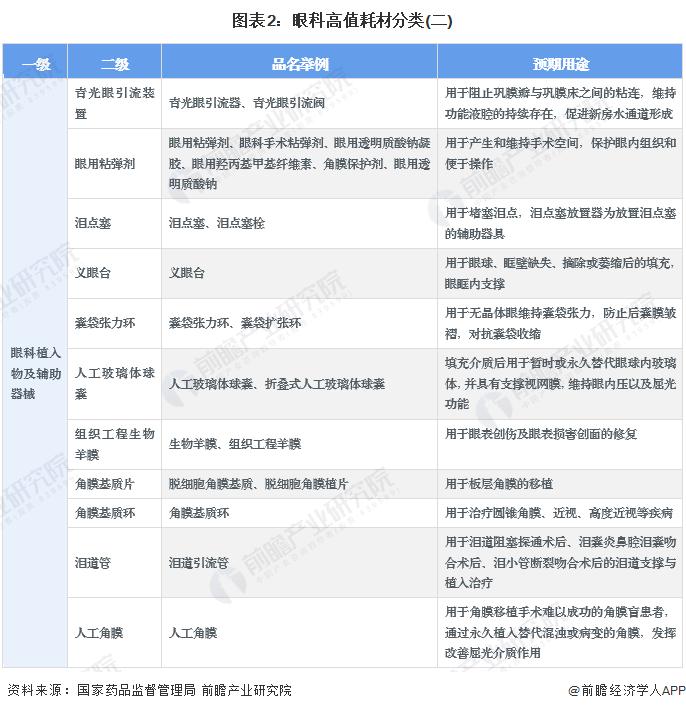

Product category: High value consumables covers 15 products

Ophthalmic high-value consumables refer to high-value medical consumables used for the treatment of ophthalmic diseases, and ophthalmic high-value consumables are included in the third class of medical devices for management. According to the Classification Catalogue of Medical Devices (2017) and the Announcement of the State Food and Drug Administration on Adjusting part of the Classification Catalogue of Medical Devices (No. 101 of 2023), High value ophthalmic consumables mainly include contact lenses, contact lens care products, intraocular lenses, intraocular fillers, glaucoma drainage devices, ocular viscoelastic agents, lacrimal spot plugs, prosthetic eye table, pouch tension ring, artificial vitreous balloon, tissue engineering biological amniotic membrane, corneal stroma slice, corneal stroma ring, lacrimal duct, artificial cornea, etc.

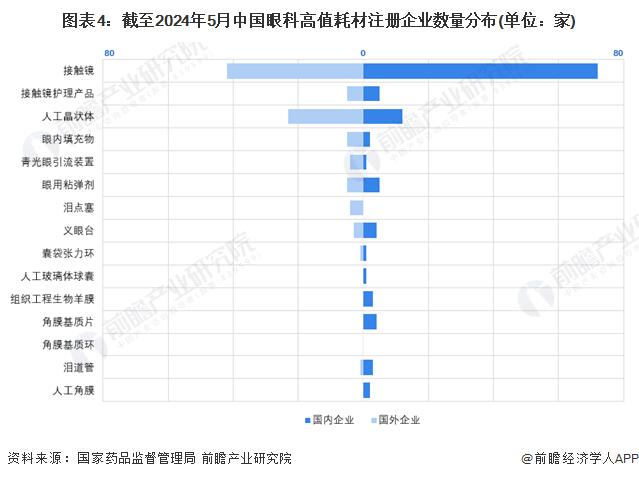

Registration: The number of contact lens registration certificates is relatively high

From the distribution of registered products, the number of contact lens product registration certificates is relatively large. As of May 2024, the State Medical Products Administration has issued 640 contact lens product registration certificates, accounting for about 72% of the total, which is much higher than other products. The second is the intraocular lens, the number of registration certificates is 169, accounting for 19%.

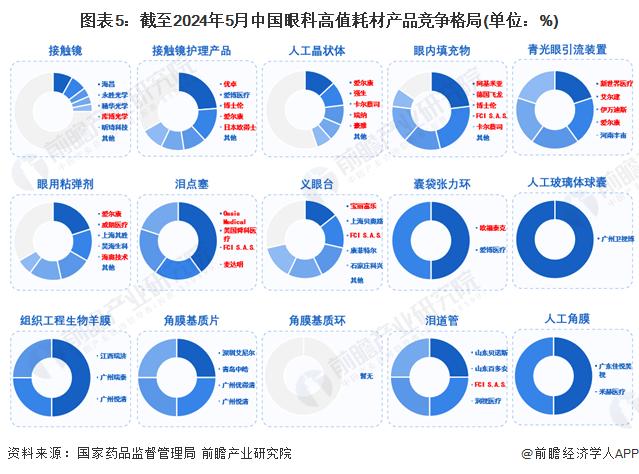

Competition: The contact lens market is the most competitive

In terms of the number of participants, the contact lens product market has a large number of participating enterprises, followed by the intraocular lens market. From the perspective of enterprise type, the number of foreign enterprises is higher than domestic enterprises in the market of intraocular lenses, intraocular fillers, glaucoma drainage devices, tear plugs and other products. In the market of contact lens, tissue engineering biologic amniotic membrane, corneal matrix, lacrimal duct, artificial cornea and other products, the number of domestic enterprises was significantly higher than that of foreign enterprises. The number of domestic and foreign enterprises participating in other product markets is basically the same.

From the perspective of the competition pattern of various market segments, the market competition of contact lens and intraocular lens products is extremely fierce, and the market is relatively dispersed, and the market concentration of TOP5 enterprises is less than 50%. The market competition of contact lens care products, ophthalmic viscoelastic agents, ocular prosthesis and intraocular fillers is fierce. The rest of the product market segments are highly concentrated, and only a few enterprise products have passed registration and approval.

Domestic substitution: Some products have been replaced by domestic substitution

According to the "China Medical Device Blue Book" data, by the end of 2022, the localization rate of three types of high-value medical consumables such as tissue engineering biological amniotic membrane, artificial vitreous balloon and corneal stroma tablets has reached 100%, and domestic substitution has been fully realized. The localization rate of contact lens, contact lens care products, eye viscoelastic agent, artificial eye table and lacrimal duct was 50% or above; The competitiveness of domestic products in the fields of intraocular lens, intraocular filler, glaucoma guidance device, lacrimal point plug, pouch tension ring is slightly insufficient, and the degree of localization is low. Overall, the localization rate of ophthalmic high-value consumables needs to be improved.

|

Last:Reprint: Foresight Network forecast 2024: "2024 China Artificial Organ Industry Panorama"

Next:Reprint: Natural China China medical device industry ushered in a transformation |

Return |