China is keen to ramp up production of medical technology to reduce its dependence on imports. Analysts discussed the impact of the policy.

China wants to use and make more of its own medical equipment.

来源:VCG via Getty Images

As a student of Chinese studies at Nanjing University in the early 1990s, Elisabeth Staudinger "experienced health care in China." As part of her research, she had to make a daring journey of more than 2,000 kilometers to Yunnan, on China's southwestern border. Parts of the province were so remote that people who needed medical care often had to wait for Monday, when visiting merchants, doctors and dentists opened their weekly markets.

"Fast forward to today, there are very reasonable hospitals and healthcare infrastructure all over the country" and almost universal health coverage, said Staudinger, who is now a board member of Siemens Healthcare, a global medical technology company based in Erlangen, Germany. "Things are much better than before." "But there's still a lot of work to be done."

China has about 1.4 billion people, a fifth of whom are over the age of 60. Jeroen Groenewegen-Lau, an analyst who studies science, technology and innovation at the Mercator Centre for China Studies, a Berlin-based think-tank, said the rise of the middle class and medical conditions associated with affluence, such as type 2 diabetes and high blood pressure, meant China was already embracing preventative care as well as treatment. And that means opening up markets for expensive treatments and technologies, he said.

Aware of the cost issue, MERICS analyst Alexander Brown said the Chinese government began pushing about a decade ago to produce and use more locally made medical equipment, especially high-end equipment such as X-ray scanners that can help with early disease detection. In 2021, the initiative ramps up in hopes of cutting costs and meeting the changing health care needs of an aging population, while promoting innovation and limiting imports to bolster national security.

The strategy is affecting the medical device industry and the entire medical technology industry in China. Medical technology includes devices that use information technology to detect, collect, and upload data. Hospitals in China have been instructed to source Chinese-made products whenever possible, and domestic and foreign manufacturers have changed their business operations and focus. In 2021, the most recent year for which data are available, China accounted for 20 percent of the medical device market, second only to the United States.

-- Gathering momentum --

The Chinese government has pursued its "Make here, buy here" strategy in a number of ways: dedicated innovation parks, subsidies and research funding for domestic medical technology companies, and centralized procurement for public hospitals.

"But technically there is only one regulation that specifically revolves around the procurement of Chinese products." Says Helen Chen, Shanghai-based managing partner of the global firm A.L.K. Consulting. In May 2021, the Ministry of Industry and Information Technology and the Ministry of Finance issued document No. 551, which includes a list of 315 products. About half of that is medical equipment such as eye lenses and medical lasers, while the rest includes equipment used in Marine, geological and geophysical work, such as ground-based radar. State-owned enterprises seeking to procure such items must ensure that 25-100% of the equipment is made of locally manufactured components.

Chen said document 551 must be seen in the broader context that "in general, China is working towards self-sufficiency in healthcare products." The document comes just a month after the Chinese government laid out a five-year plan to push six or more Chinese companies into the top 50 global medical device companies, up from just four in the top 100 in 2021. But China's ambitions to boost the medical device industry go back even further. In 2010, medical devices were identified as one of 20 strategic emerging industries, along with biotechnology, renewable energy and the Internet of Things, and the central government began to draw up a five-year plan for the sector.

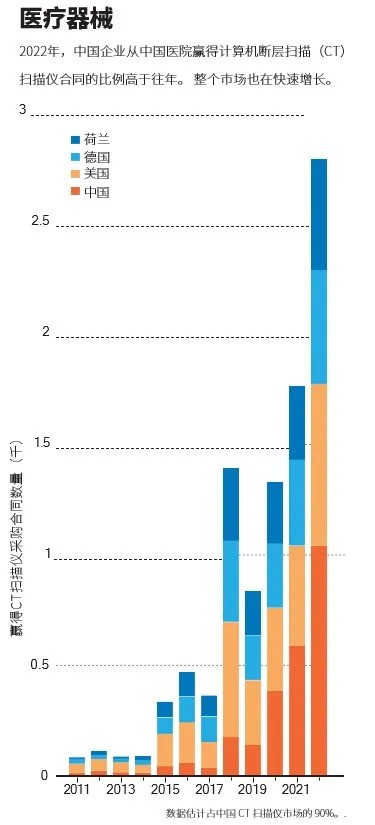

The shift to products such as high-value imaging, diagnostic, and therapeutic devices, including computed tomography (CT) scanners, ultrasound, and dialysis machines, as well as implanting devices such as pacemakers, is particularly notable because, until now, the medical manufacturing industry focused on syringes, gloves, gauze, and other low-end disposable items (see "medical devices").

Source: Alexander Brown/Merics

But for industry watchers like Chen, the real change came in 2015, when the government announced the Made in China 2025 (MIC2025) initiative. The strategic plan boldly states that China aims to become a global manufacturing powerhouse by 2025 in 10 industries, including robotics, electric vehicles and medical devices. China hopes to achieve this by improving the capabilities of local industries in research and development, design and procurement of key components, as well as moving the assembly process domestically.

One of the goals of MIC2025 is to localize 70% of mid - and high-end medical devices by 2025, and to increase this proportion to 95% by 2030.

With the first deadline just a year away, Brown said, "I think they still have a way to go." Compared with areas such as new energy vehicles, they are not catching up fast enough."

"But it's not for lack of effort - China has been pumping a lot of money into the industry." I think some of these barriers have to do with the highly specialized nature of medical devices." Brown added. "That said, Made in China has the biggest impact in building local industrial capacity."

China's ambitions for its medical device industry are the same. A number of policy and financial initiatives have emerged since MIC2025 to promote domestic production and use of medical devices. For example, in April 2022, the governments of Anhui, Hubei and Shanxi provinces required hospitals to limit medical and testing equipment to domestic production.

The government has also begun offering incentives such as rent waivers to entice companies to relocate or set up offices in four medical device industrial zones - the Bohai Rim economic Circle, which includes Beijing; the Yangtze River Delta, which includes Shanghai; the Pearl River Delta, which comprises Guangdong, Shenzhen and several other cities; and central China, which includes Wuhan, Chengdu and Chongqing. China has also increased tax incentives for R&D investment: Tax incentives for R&D investments rose from 1.7 billion yuan ($236 million) in 2017 to 11.4 billion yuan in 2022, according to a MERICS analysis of 122 medical technology companies listed on the Shanghai, Shenzhen and Beijing stock exchanges (see go.nature.com/3urvdkn).

In July 2023, the magnetic resonance imaging (MRI) instrument developed by Shenzhen Institute of Advanced Technology began mass production. At the beginning of the COVID-19 epidemic, Shanghai United Image Medical provided more than 100 domestic CT scanners and X-ray machines to hospitals in Wuhan, Shanghai and Beijing.

In 2019, Shanghai Minimally Invasive Medical Group, one of China's largest medical technology companies, reported that surgeons successfully performed the first prostate-removal operation using its laparoscopic robot Toumai. The four-arm Toumai can perform complex surgeries within narrow Spaces of the body, such as urethral reconstruction. It can even be operated remotely.

-- Far-reaching influence --

According to consulting firm Deloitte's 2021 analysis (see go.nature.com/3uyujzw), the market revenue of China's medical device industry more than doubled between 2015 and 2019, with annual growth rates consistently outpacing GDP growth, growing by about 20 percent since the launch of MIC2025.

Some industries are even starting to turn the tide on trade - for example, pacemaker makers' global exports increased by 110% between 2015 and 2020. At the same time, pacemaker sales to China by foreign competitors rose 2 percent.

Overall, the market share of domestic brands producing high-end equipment has risen from 20 percent to 30 percent over the past decade. However, US and European multinationals such as Siemens, GE Healthcare and Medtronic continue to dominate the industry, said Rohit Anand, an analyst at GlobalData, a consultancy based in Hyderabad, India. The difference in market share comes down to "huge differences in product quality, scale and efficiency," he said.

Some parts of high-end equipment, such as computed tomography scanners, are now made in China.

Some parts of high-end equipment, such as computed tomography scanners, are now made in China.

source:Feature China/Future Publishing via Getty

Brown pointed out that medical devices are niche products that require expertise, and it is difficult for Chinese companies to gain a foothold.

Citing medical robots as an example, he added: "There is not a big market in China because they are very expensive. The average Chinese customer simply can't afford to pay that, and those who can might choose a leading American company over some inexperienced Chinese company."

However, attitudes among medical professionals are changing. A 2020 survey of Chinese hospital workers by L.E.K. Consulting found that 3 percent "use Chinese materials whenever possible." In a follow-up survey a year after Document 551 was released, about 30 percent said they always used Chinese materials (see go.nature.com/3iba26v).

Alan MacCharles, an analyst at Deloitte in Shanghai, said that usually these decisions are based on facts. "You might have two or three options, and the doctor might say: 'Western equipment might be a little bit better, but because I haven't been trained in that system for a while, I'm more proficient with the Chinese brand.'" '"

Due to the new procurement regulations, many international manufacturers have chosen to establish local operations in China. Some have partnered with local companies to set up joint ventures, such as the one between Beijing Sinopharm Imaging and GE Healthcare of the US, or Shanghai Electric and Siemens.

Some famous foreign companies have set up their own manufacturing plants in China. Nissen Micon, based in Kobe, Japan, currently assembles its blood and urine testing equipment in Shandong. Similarly, Dutch company Philips produces some high-end scanners in China, such as its EPIQ Elite ultrasound series, which includes an AI-powered cardiovascular machine. In 2020, Philips launched the China-made Ingenia Ambition MRI, which reduces scanning time by 50%. It is the first MRI to operate without helium, a non-renewable resource in scarce supply.

At an international trade show last May, GE Healthcare showcased 23 medical devices, 18 of which were manufactured and developed in China. One of the highlights, GE Healthcare said, is the ultra-high-end Revolution CT scanner, which has the ability to perform coronary examinations "at the next heartbeat in any heart rate and rhythm condition." The company began production of the scanner at its Beijing plant in 2020. Seventy percent of the CT equipment the company ships to customers worldwide is manufactured at the facility.

The decision to start production in China was not taken lightly. "It's not an easy process because of the high cost of building factories for high-end equipment," MacCharles said. "You could have local supply chain and intellectual property issues, it would take years to get fully certified, and basically you wouldn't be able to produce anything for quite some time."

Grace Fu Palma, founder of Beijing-based China Med Device, said U.S. companies in particular face challenges given the ongoing tensions between the two countries. The consulting firm provides regulatory and business advice to foreign companies seeking to enter the Chinese market. "The political situation will definitely have a negative impact on the entry of foreign companies."

Despite the increased pressure on customers to buy from local companies, China remains a priority for Siemens, which has operated in the country for more than 30 years and has six research and development sites in the country, Staudinger said. "The rules are sometimes seen as an attempt to get foreign companies to leave the country," she said. "But that's not what we experience."

"As long as you get involved and join the trend of supporting China to build a strong, high-quality healthcare system, you will feel very welcome," Staudinger said.

|

Last:Reprint: Market segment analysis of China ophthalmic high-value consumables industry in 2024

Next:Reprint: In the big data of endoscopic ultrasound in 2024, domestic brands ranked first |

Return |